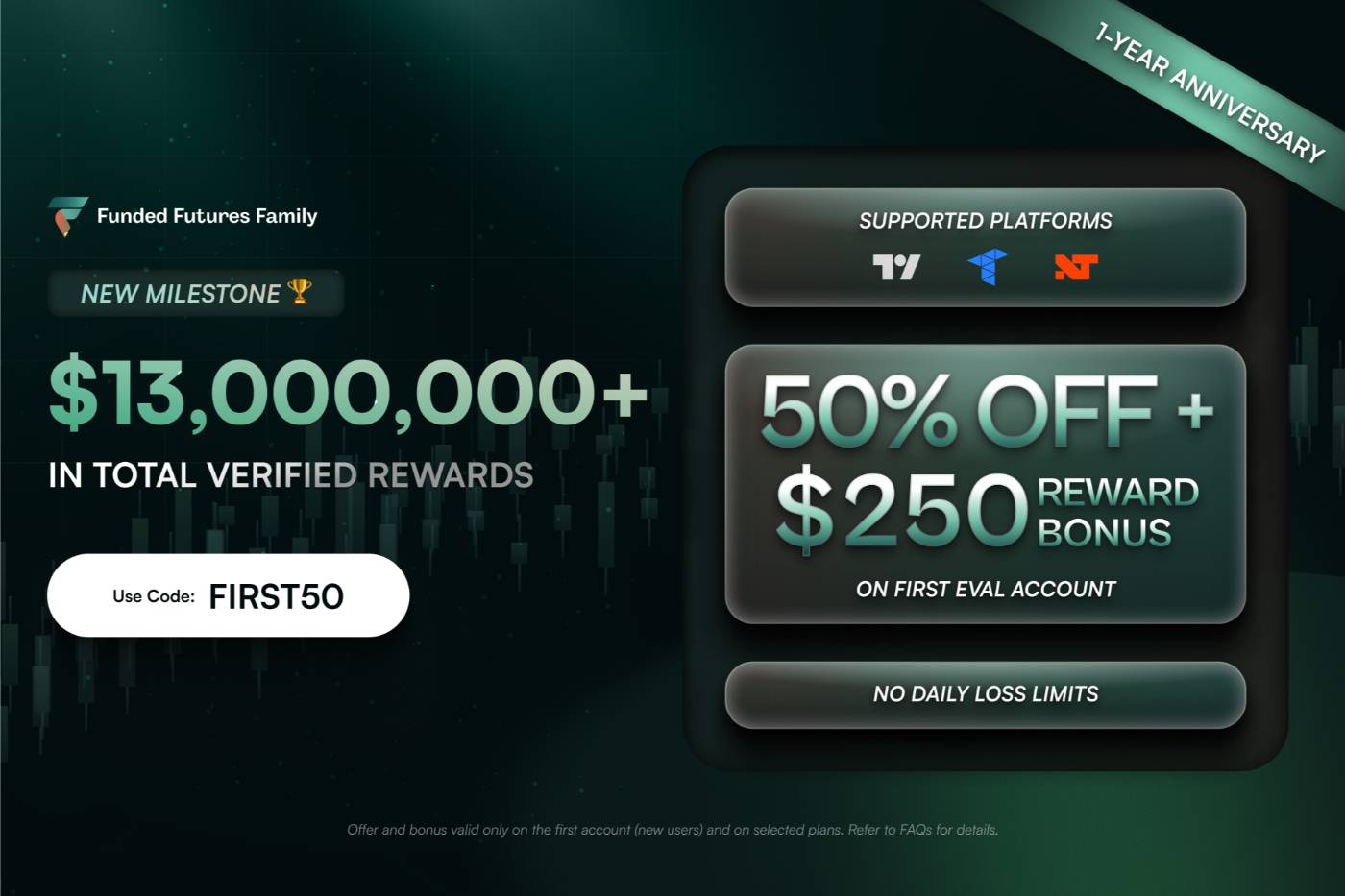

Most “futures trading strategies” articles teach entries and indicators, but ignore the one thing that decides whether you keep trading long enough to withdraw: funded-account rules. Funded Futures Family is built around measurable consistency—7 qualifying $+ winning days and a staged consistency cap—so the best futures trading strategies here are chosen specifically because they can survive that environment.fundedfuturesfamily+1

This guide teaches futures trading strategies through the lens of risk, pacing, and repeatability—then shows where Funded Futures Family’s structure supports those habits without needing hype or unrealistic claims.

Funded Futures Family constraints you must design around

- Payout eligibility: At least 7 different trading days, each with gains (days don’t need to be consecutive, and the count resets after each payout).

- Consistency rule: 40% for payouts 1–3, 45% for payouts 4–5, and 50% from payout 6 onward (limits how much one day can contribute to total profits).

- Evaluation pacing: Classic evaluations require at least 2 trading days; Elite/Premiere can pass in 1 day (as published in the evaluation help article).

Implication: the “best” futures trading strategies in a funded environment are usually not the ones with the biggest single-day upside—they’re the ones that can produce steady, repeatable green days without oversized spikes. Funded accounts with Funded Futures Family aims at upgrading the entire trading experience for all traders.

A simple framework: 3 strategy families (pick one, then specialize)

Most profitable futures approaches fall into three families: trend-following, mean reversion, and breakouts. Each can work in funded accounts—but only if the execution is adapted for consistency rules and drawdown mechanics.

Strategy-family selection (fast decision rules)

- Trend-following: Better when markets are directional and you can hold winners longer, but it requires strict risk control to avoid giving back gains.

- Mean reversion: Better in range-bound conditions; it can fail in strong trends if you “fade” too early.

- Breakouts: Good for volatility expansions, but false breakouts are common—risk must be pre-defined.

Strategy #1: Trend-following for funded accounts (the “two-stage runner”)

Trend-following is simply “trade with the bigger push.” Instead of trying to call tops/bottoms, the goal is to get aligned with direction and let the market pay you if it keeps moving. This style can fit funded rules well because it naturally supports many medium green days, not one oversized lottery day.

Entry logic (keep it boring)

You want a rule that keeps you out of chop and prevents emotional flip-flopping.

- Directional filter: Only trade in the direction of the trend (examples: higher highs/higher lows; price above a moving average with the MA sloping up; or lower highs/lower lows with MA sloping down). The purpose is to avoid taking “countertrend” trades that usually have worse follow-through when the market is already moving with momentum.

- No “revenge flips” in the same session: If you go long, get stopped, then immediately go short (and then long again), you’re basically paying spread/commission in a noisy zone and increasing your chance of a bad day. In funded accounts, that churn matters because it raises drawdown risk and makes it harder to stack clean qualifying days.

Exit logic (consistency-aware)

The “two-stage runner” concept is: secure a base hit first, then give the remaining position room to run.

- Partial profit first: Take a portion off at a predefined level (like 1R, a prior swing, or a key level). This puts realized profit into the day so you’re less likely to turn a good trade into a scratch/loser because you got greedy.

- Trail the rest: Keep a smaller “runner” position with a trailing stop (structure-based or indicator-based). This is where trend-following makes its money—when you catch the occasional extended move—without needing to size up aggressively.

- Daily “profit ceiling” near consistency limits: If you’re nearing a day that could become too large relative to total profits, stop trading once you’ve locked a clean day. This matters because Funded Futures Family’s consistency rule limits how much of your total profits can come from your biggest day (40% early in the payout path), so the goal is to avoid creating a single day that forces you to grind extra days just to dilute that percentage.

How it matches Funded Futures Family

Funded Futures Family requires at least 7 different days with profit for payout eligibility, and qualifying day counts reset after each payout—so repeatedly producing “clean” days is the game. The consistency rule also rewards traders who build profit steadily instead of relying on one massive day (40% cap for payouts 1–3, increasing later).

Strategy #2: Mean reversion (range trading without death-by-trend)

Mean reversion is “price stretched away from average tends to snap back.” Traders usually use tools like RSI, Bollinger Bands, and moving averages to define what “stretched” means. The big danger is simple: in a true trend, price can stay overbought/oversold longer than you can stay comfortable, so mean reversion needs a regime filter and strict risk design.

Only trade it in the right regime

Mean reversion performs best when the market is rotating (back-and-forth) rather than trending.

- Prefer range conditions: MetroTrade describes this strategy as most effective in sideways/range-bound markets, where price bounces between support and resistance.

- Treat strong trends as “no-trade” or reduced-size: When momentum is persistent, “overbought” can stay overbought and keep pushing. The funded-friendly adjustment is: either skip, or trade smaller with tighter selection, because the probability of a deeper adverse move is higher.

Risk design (non-negotiable)

Mean reversion can have a high win rate in ranges, but the losers can be nasty if you don’t cap them.

- Use smaller size than trend-following: Because when you’re fading a move, you are (by definition) stepping in front of momentum—so you must assume the market might go further against you than expected. MetroTrade explicitly highlights that risk management is critical and notes the role of smaller sizing and stop losses.

- Predefine the stop before entry: You need a point where the trade thesis is invalid (example: “if price breaks and holds beyond range boundary, the range thesis is wrong”). This prevents the “I’ll just give it more room” spiral.

- Never average down as a rescue plan: Adding to losers is how mean reversion turns into account death during trends—especially with leverage. MetroTrade specifically warns to avoid doubling down and to stick to a plan.

Why this matches Funded Futures Family

Because Funded Futures Family payouts depend on stacking multiple $+ days (and those qualifying days reset after payout), mean reversion can be used as a “base hit” strategy—small, repeatable days—if you only run it in range regimes and keep losses tight.

Strategy #3: Breakout trading (with a false-breakout shield)

Breakouts are when price pushes beyond a well-watched support/resistance level and continues, often with a volatility expansion. Optimus Futures describes breakouts as moves beyond established support/resistance, and notes that a breakout that falls back to pre-breakout levels is considered a false/failed breakout. In funded accounts, breakouts are attractive because one clean breakout can be your entire qualifying day—if you don’t give it back via overtrading.

The funded version: “breakout + retest”

The “false-breakout shield” is mainly about not buying/selling the first spike.

- Step 1: Identify a real level: A level matters because many traders place orders around it (stops, entries, exits), which can create an explosive move when it breaks. Optimus highlights how support/resistance zones are where bulls and bears disagree, and the break can trigger sharp movement.

- Step 2: Wait for the break, then the retest/hold: Optimus specifically calls out “pullback and retest” as a critical validation technique—genuine breakouts often revisit the breakout level, offering a safer entry and helping filter fakeouts.

- Step 3: If no retest happens, reduce size: When price never retests and just rips, entries are higher-risk because you’re buying extended price. In funded terms: treat it like a “B-setup” and size down so one fakeout doesn’t ruin the day.

Payout-eligibility alignment (“one-and-done”)

- Make the breakout trade your day: If the breakout gives you the $+ day, stop trading and protect the qualifying day. This directly aligns with the requirement for 7 separate $+ green days.

- Avoid giving back the day: Overtrading after a win is one of the easiest ways to turn a qualifying day into a scratch/red day, which slows payout progress. The structure of “one setup, then stop” matches the incentives.

How to Trade Breakouts for Funded Futures Family Payouts

Funded Futures Family’s payout rules reward repeated qualifying days ($+ per day, minimum 7 days) and discourage “one huge day” behavior via the consistency rule. Breakout trading—especially with a retest filter—supports quick, controlled wins, and then stopping helps keep the day clean for eligibility.

If you want, this can be rewritten into a tighter “playbook format” (Setup → Trigger → Entry → Stop → Target → When to stop trading for the day) for each strategy.

Funded Futures Family features that help strategy execution.

These aren’t “reasons to join,” but practical supports that map to the strategies above:

- Clear payout structure: The help center states the 7-day requirement, the $+ definition, and the staged consistency caps (40%/45%/50%).

- Evaluation flexibility: The evaluation guide states Classic requires 2 separate days, while Elite/Premiere can pass in 1 day, letting traders choose a pace that fits their style.

- Public rules reference: Funded Futures Family publishes rules examples (including consistency calculations) that traders can use as a checklist, not a guessing game.