If you’re comparing Take Profit Trader with Funded Futures Family, the decision usually comes down to one thing: how each firm turns “profitable trading” into approved withdrawals—without rule surprises. Take Profit Trader emphasizes withdrawals from day one (once conditions are met), while Funded Futures Family publishes a structured payout pathway built around qualifying days, consistency caps, and clear payout batches.

This page breaks both firms down using a rules-first lens, so traders can choose the program that fits their style, temperament, and payout goals—while giving a slight edge to Funded Futures Family for traders who want predictable payout cycles and transparent eligibility math.

Both firms can be viable, but they “reward” different trading behavior.

Take Profit Trader (what stands out)

- Profit split (PRO): Take Profit Trader states that in the PRO account the profit split is 80/20, with the trader keeping 80%.

- Day-one withdrawals (with conditions): Take Profit Trader states you can withdraw on day one in a PRO account, but you must first build a buffer.

- Buffer logic: Take Profit Trader states you can withdraw profits at 80% once you reach the level of your maximum drawdown (their “buffer zone”), and provides examples like needing $52,000 on a $50,000 account before withdrawing.

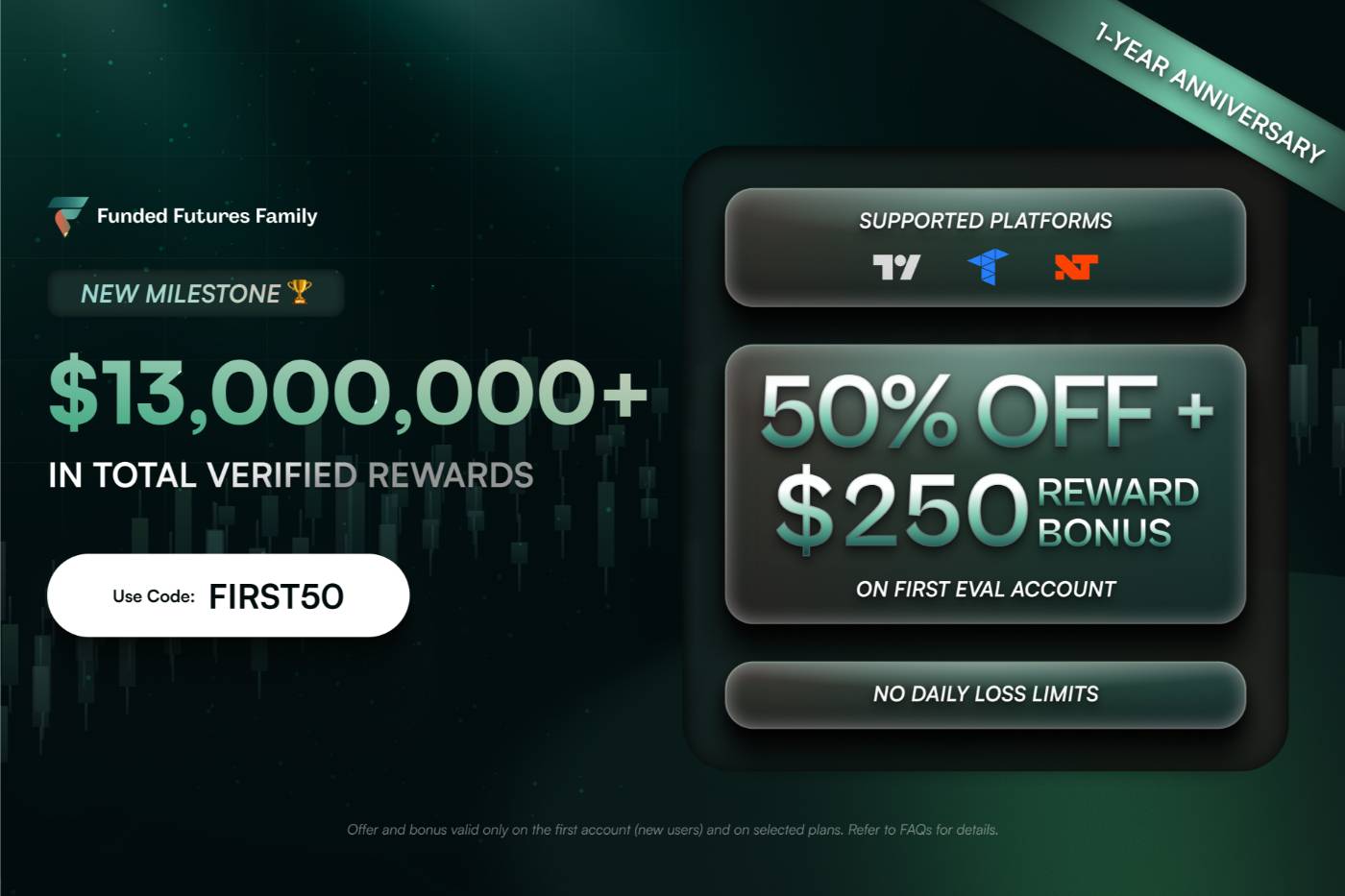

Funded Futures Family (what stands out)

- Qualifying-day payouts: Funded Futures Family states you must log 7 qualifying trading days per payout cycle, each with $+ gains, and the count resets after each payout.

- Consistency caps: Funded Futures Family states a staged consistency rule: 40% for payouts 1–3, 45% for payouts 4–5, 50% for payout 6+.

- Clear payout cadence: Funded Futures Family states approved payouts are processed every Tuesday & Friday, with cutoffs at Monday 5 PM EST and Thursday 5 PM EST.

The Trader Implication of Take Profit Trader

- If you’re consistently profitable but your profits stay inside the buffer zone, you might feel like you’re winning while still being “not withdrawal-eligible.”

- If you like clear milestones this is psychologically easier than firms where eligibility is more subjective.

What is the benefit of Funded Futures Family, exactly?

Funded Futures Family is structured around “repeatable payout eligibility” using a fixed definition of a trading day and a set minimum-day requirement. Funded Futures Family states a trading day is any day with at least one trade placed between 6:00 PM EST and 5:00 PM EST the following day, and that payout eligibility requires 7 qualifying days of $+ gains.

Funded Futures Family also states that once a payout request is submitted, it cannot be edited or canceled, which encourages traders to self-check balances and buffer requirements before submitting.fundedfuturesfamily+1

Rules that change how you trade (not just how you withdraw)

This is where most comparisons go wrong: traders compare “profit split” and ignore the rule that will force them to change their strategy.

Take Profit Trader: the buffer is the centerpiece

Take Profit Trader’s PRO withdrawal rules emphasize that the buffer equals maximum drawdown and that reaching the buffer level is what unlocks standard withdrawals. That tends to reward traders who can grind up steadily and protect profits long enough to “get outside the buffer.”

Funded Futures Family: day-count + consistency drives behavior

Funded Futures Family’s payout requirements explicitly push traders toward building a “series of clean days” because each payout cycle needs 7 qualifying days and is constrained by a consistency cap (40%/45%/50%). This often favors traders who can reliably hit modest daily targets and stop trading once the day is secured.

Which firm is better for which trader?

No firm is “best” for everyone, but there are clear best-fit profiles.

Choose Take Profit Trader if…

- You prefer a milestone-based system where withdrawals unlock after clearing a defined buffer tied to drawdown size.

- You want the option to withdraw early once eligible (because withdrawals are framed as available day one after meeting buffer conditions).

- You’re comfortable optimizing around an 80/20 split in the PRO phase.

Choose Funded Futures Family if…

- You want a published, repeatable path: 7 qualifying days, staged consistency rules, and fixed payout processing days.

- You prefer predictable operations (Tuesday/Friday processing, clear cutoffs) to reduce “when do I get paid?” ambiguity.

- You like that payout eligibility is described with concrete definitions (what counts as a trading day, what happens if balance drops below buffer after request).

Slight edge to Funded Futures Family: traders who struggle with “one huge day then give-back” often do better when the rules encourage pacing and consistency rather than occasional spikes. Funded Futures Family tends to offer above average trading conditions when compared to other top firms like tradeify, lark funding etc.

A practical safeguard

Before requesting any payout, do a 2-minute “post-withdrawal balance check”:

- If the withdrawal leaves you emotionally pressured to “win it back,” you’re withdrawing too aggressively.

- If your strategy needs breathing room, protect the buffer first, withdraw second.

FAQs